1-2-3 Up Pattern and Key Trading Setups Explained

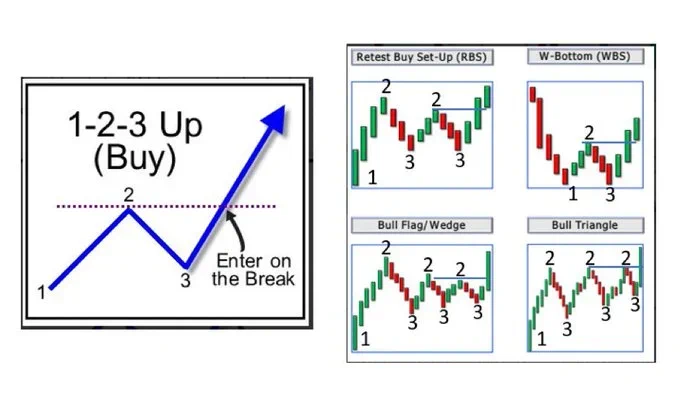

1-2-3 Up (Buy) and Setup Patterns

Overview of 1-2-3 Up (Buy) Pattern

- 1-2-3 Up (Buy) :

- This pattern involves a series of price movements forming three notable points.

- 1 - This is the initial low point after a downtrend.

- 2 - Following point 1, the price bounces to a high point.

- 3 - The price then pulls back to a higher low compared to point 1.

- Enter on the Break: The optimal entry point is when the price breaks above point 2.

Detailed Breakdown of Setup Patterns

Retest Buy Set-Up (RBS)

- 1: The price forms the initial low.

- 2: The price rallies to a high, forming the peak.

- 3: After a pullback, the price forms a higher low.

- Buy signal: The signal is confirmed when the price surpasses point 2.

W-Bottom (WBS)

- 1: Initial low or bottom is formed.

- 2: The price rises to a peak.

- 3: The price revisits a level around point 1, forming a W pattern.

- Buy signal: The signal is confirmed on the break above point 2.

Bull Flag/Wedge

- 1: The price starts with a low.

- 2: The price surges to a higher point.

- 2: The price consolidates in a downward channel or wedge.

- 2: Small peaks during consolidation.

- 3: The price forms a higher low, completing the flag or wedge.

- Buy signal: Entry point is confirmed at the breakout above point 2.

Bull Triangle

- 1: A notable low points before the trend begins.

- 2: The price hikes to a higher high.

- 2: Series of diminishing highs and higher lows form a triangle pattern.

- 3: The price forms a higher low within the triangle.

- Buy signal: Confirmation occurs once the price breaks above the triangle resistance (point 2).

Summary and Additional Thoughts

- Pattern Recognition: Identifying these patterns can be crucial for traders aiming to capitalize on breakout opportunities.

- Market Context: These patterns usually follow a clear downtrend and appear during market reversals.

- Risk Management: Proper stop-loss levels at or slightly below point 3 can help manage trade risks.

- Confirmation: Volume spikes and additional indicators (e.g., moving averages, RSI) can be used for further confirmation before entering a trade.

Reference:

www.warriortrading.com

Bull Flag Chart Pattern & Trading Strategies

centerpointsecurities.com

Bull Flag Chart Patterns Trading Guide - CenterPoint Securities

www.forex.com

11 Trading Chart Patterns You Should Know - FOREX.com US

Technical Analysis Chart Patterns

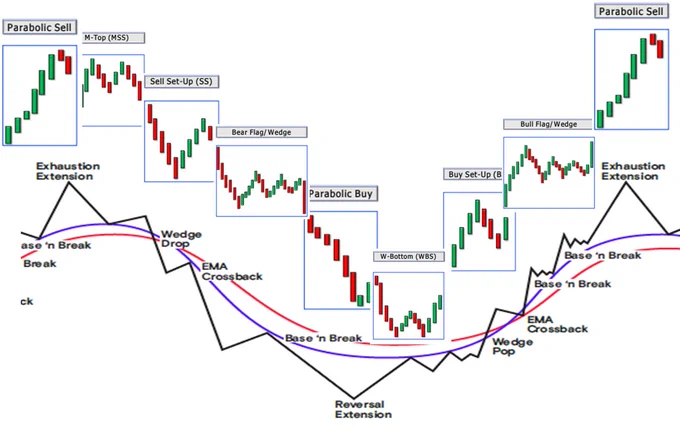

Parabolic Sell

- Definition: Signals a sharp upward price movement, often unsustainable.

- Explanation: This usually means that a rapid price increase has occurred and may be due for a correction.

M-Top (MSS)

- Definition: A bearish reversal pattern shaped like the letter 'M', indicating a double top pattern.

- Explanation: This indicates that the price reached a resistance level twice and failed to break higher, signaling a potential reversal to the downside.

Sell Set-Up (SS)

- Definition: A formation indicating a future decrease in price.

- Explanation: This is a precursor to a bearish movement often characterized by minor peaks before a drop.

Exhaustion Extension

- Definition: When a price trend is extended beyond typical levels and is likely due for consolidation or a reversal.

- Explanation: After a strong uptrend, exhaustion extensions suggest that buyers might be losing momentum.

Base 'n Break

- Definition: A pattern indicating a consolidation base followed by a breakout.

- Explanation: This is often an area where traders look for breakout opportunities, suggesting further momentum in the direction of the break after consolidation.

Wedge Drop

- Definition: A bearish pattern formed by converging trendlines.

- Explanation: Often signals a reversal or continuation of the downward trend after a period of consolidation.

EMA Crossback

- Definition: A situation where a short-term EMA crosses back over a long-term EMA.

- Explanation: This cross signals potential reversals or trend continuations, depending on the direction of the cross.

Parabolic Buy

- Definition: Opposite of Parabolic Sell, indicating sharp upward momentum.

- Explanation: Suggests a strong buying pressure driving the prices up quickly.

Bear Flag/Wedge

- Definition: A continuation pattern in a downtrend that looks like a small upward sloping channel.

- Explanation: Indicates a brief consolidation before the market continues its downtrend.

W-Bottom (WB5)

- Definition: A bullish reversal pattern shaped like the letter 'W'.

- Explanation: This occurs when the market forms two lows near the same level and is considered a strong reversal indicator in a downtrend.

Buy Set-Up (B)

- Definition: A formation indicating a future increase in price.

- Explanation: This is a precursor to a bullish movement often characterized by minor dips before a rise.

Bull Flag/Wedge

- Definition: A continuation pattern in an uptrend that looks like a small downward sloping channel.

- Explanation: Indicates a brief consolidation before the market continues its uptrend.

Wedge Pop

- Definition: The point where price exits a wedge formation.

- Explanation: Often signals a renewed momentum in the direction of the pop, either upward or downward.

Reversal Extension

- Definition: An extended move in the opposite direction of the previous trend.

- Explanation: Suggests a significant change in market sentiment and can indicate the start of a new trend.

This chart illustrates various technical analysis patterns and signals commonly used to predict market movements and trends. Understanding these patterns is crucial for making informed trading decisions.

Reference:

www.brookstradingcourse.com

Emini parabolic wedge sell climax and double bottom with ...

www.cityindex.com

11 Trading Chart Patterns You Should Know - City Index SG

howtotrade.com

How To Trade The Parabolic Pattern (in 3 Easy Steps) - HowToTrade