Beginners' Guide to Portfolio Allocation Strategies

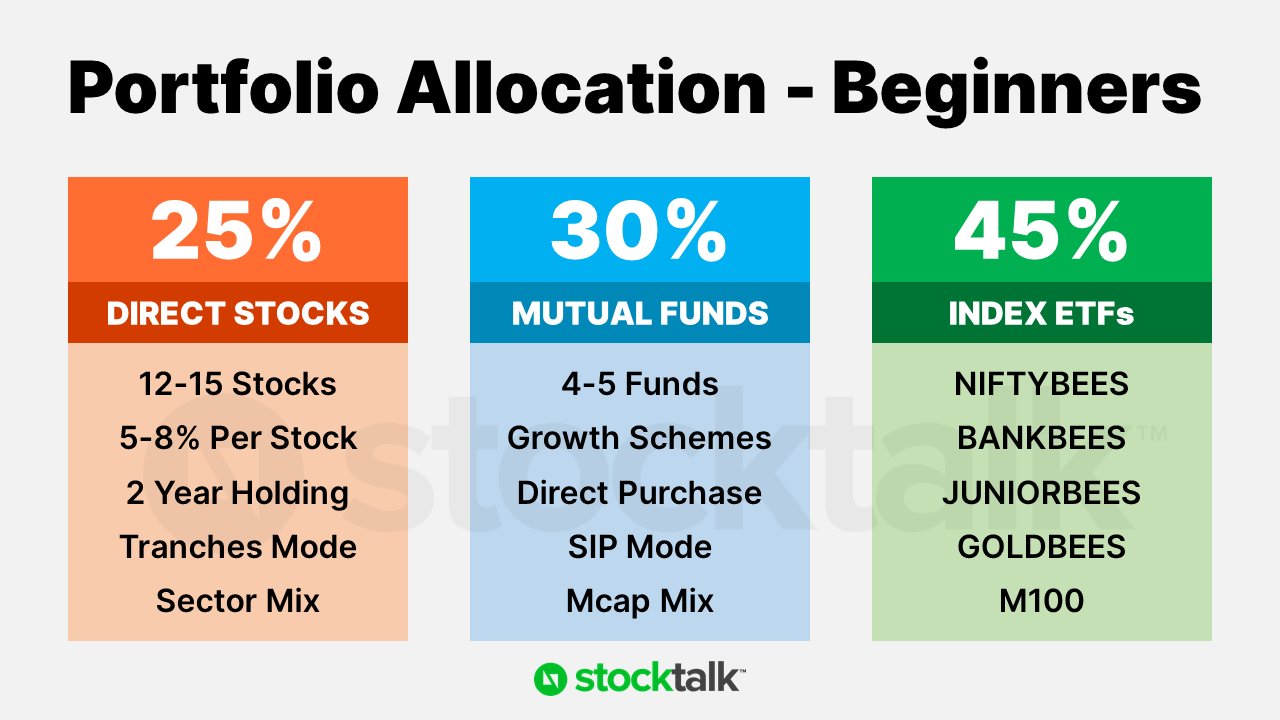

Portfolio Allocation - Beginners

Overview

This image provides a beginner-friendly guide for allocating a financial portfolio, dividing investments into three main categories: Direct Stocks, Mutual Funds, and Index ETFs.

Direct Stocks (25%)

Key Points:

- Percentage Allocation: 25% of the portfolio should be allocated to direct stocks.

- Number of Stocks: Invest in 12-15 different stocks.

- Per Stock Allocation: Allocate 5-8% of your capital to each stock.

- Holding Period: Aim for a 2-year holding period for these stocks.

- Investment Approach: Use the tranches mode, which involves buying shares in intervals rather than all at once.

- Diversity: Ensure a mix across different sectors to diversify risk.

Thoughts:

Diversifying your stocks across various sectors helps mitigate risks. Holding stocks for at least two years can prevent impulsive selling and allows the investor to benefit from long-term growth.

Mutual Funds (30%)

Key Points:

- Percentage Allocation: 30% of the portfolio should be allocated to mutual funds.

- Number of Funds: Invest in 4-5 different mutual funds.

- Type of Schemes: Opt for growth schemes for potential capital appreciation.

- Purchase Mode: Direct purchase tends to have lower fees compared to purchasing through intermediaries.

- Investment Method: Systematic Investment Plan (SIP) mode helps in investing consistently over time, averaging out the cost.

- Market Capitalization Mix: Ensure a good mix of small-cap, mid-cap, and large-cap funds to balance risk and returns.

Thoughts:

SIP mode encourages disciplined investing and can help in purchasing more units when prices are low and fewer units when prices are high. Direct purchase of mutual funds can save on commission fees.

Index ETFs (45%)

Key Points:

-

Percentage Allocation: 45% of the portfolio should be allocated to Index Exchange-Traded Funds (ETFs).

-

Types of ETFs:

Name Description NIFTYBEES Tracks Nifty 50 Index BANKBEES Tracks banking sector JUNIORBEES Tracks Nifty Junior Index GOLDBEES Tracks gold prices M100 Tracks diversified index

Thoughts:

Index ETFs provide a way to invest in a broad market index with lower expenses compared to actively managed funds. They are less risky compared to individual stocks and offer a way to hold a diversified portfolio with simplicity.

Summary

This portfolio allocation strategy for beginners emphasizes diversification and spreading investments across different asset classes and sectors. By combining direct stocks, mutual funds, and index ETFs, investors can achieve a balanced portfolio that manages risk while pursuing growth.

Reference: